AARP Secondary Insurance to Medicare provides additional coverage beyond what Medicare offers, ensuring beneficiaries have comprehensive and enhanced healthcare benefits. Exploring the relationship between these two insurance options sheds light on the valuable advantages they bring to individuals seeking optimal healthcare protection.

Detailing the eligibility criteria, benefits, coverage options, and cost information associated with AARP Secondary Insurance to Medicare will give a comprehensive understanding of how this insurance plan complements and supplements Medicare coverage effectively.

Overview of AARP Secondary Insurance to Medicare

When it comes to healthcare coverage, AARP secondary insurance plays a crucial role in enhancing the benefits provided by Medicare. While Medicare covers a wide range of medical services, there are gaps in coverage that AARP secondary insurance helps fill.

Complementing Medicare Benefits

- AARP secondary insurance can cover expenses such as deductibles, copayments, and coinsurance that Medicare may not fully pay for.

- It can also provide coverage for services like dental, vision, and hearing aids, which are not included in original Medicare plans.

- Prescription drugs can also be covered under AARP secondary insurance, offering additional financial assistance for medication costs.

Eligibility Criteria for AARP Secondary Insurance: Aarp Secondary Insurance To Medicare

To qualify for AARP secondary insurance, individuals must meet certain requirements that are closely tied to Medicare enrollment. Here are the details:

Age Requirement, Aarp secondary insurance to medicare

To be eligible for AARP secondary insurance, individuals must be at least 65 years old. This is because Medicare coverage typically begins at age 65, and AARP secondary insurance is designed to complement and enhance Medicare benefits for seniors.

Enrollment Conditions

In order to enroll in AARP secondary insurance, individuals must first be enrolled in Medicare Part A and Part B. This means that they must have Original Medicare coverage before they can apply for AARP secondary insurance.

Ties with Medicare Enrollment

The eligibility for AARP secondary insurance is closely linked to Medicare enrollment because AARP secondary insurance is meant to fill the gaps in coverage left by Original Medicare. By requiring individuals to be enrolled in Medicare Part A and Part B, AARP ensures that its secondary insurance is providing additional benefits and coverage to those who already have basic Medicare coverage.

Benefits and Coverage Options

When it comes to AARP secondary insurance to Medicare, there are a variety of benefits offered to beneficiaries that can enhance their overall coverage.

Specific Benefits Offered

- Extended Coverage: AARP secondary insurance can provide coverage for services not fully covered by Medicare, such as dental, vision, and hearing care.

- Lower Out-of-Pocket Costs: With AARP secondary insurance, beneficiaries may have lower copayments and deductibles, reducing their overall healthcare expenses.

- Prescription Drug Coverage: AARP secondary insurance plans often include coverage for prescription drugs, filling the gap left by Medicare Part D.

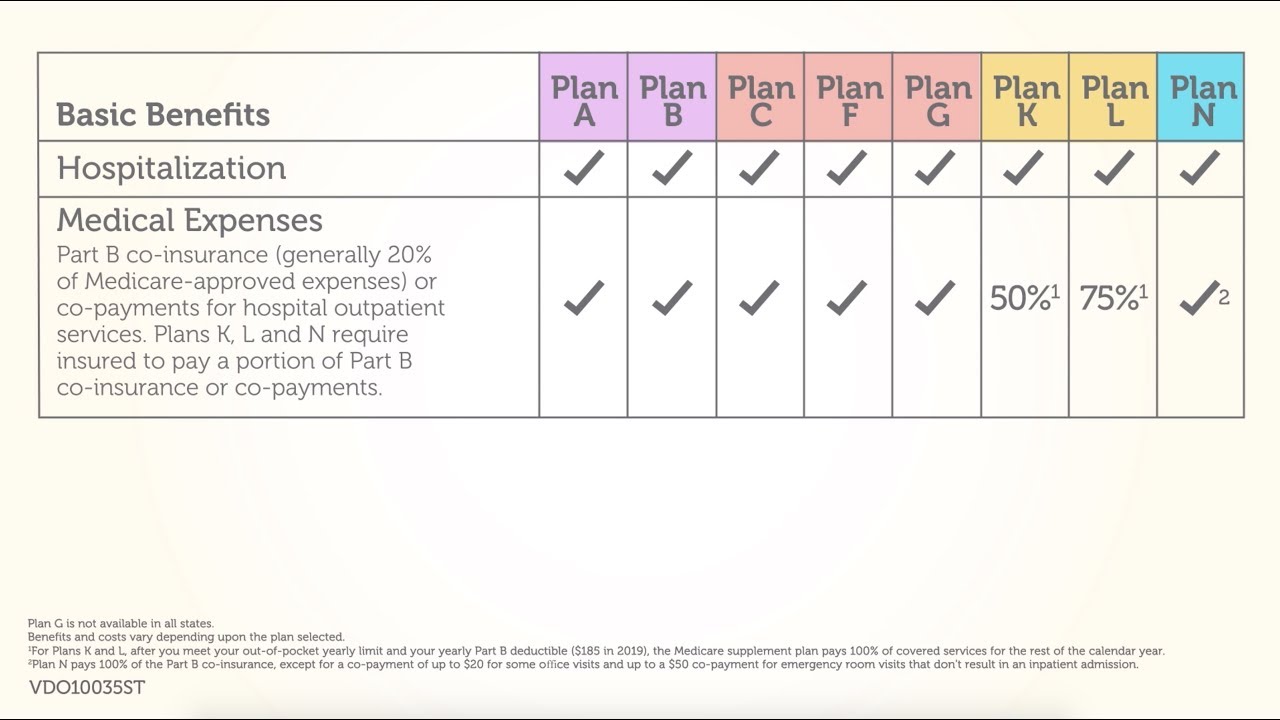

Comparison of Coverage Options

When comparing coverage options available under AARP secondary insurance plans, beneficiaries can choose from different plans based on their individual needs and budget.

| Plan | Coverage |

|---|---|

| Plan A | Basic coverage for essential healthcare services. |

| Plan B | Enhanced coverage including prescription drug benefits. |

| Plan C | Comprehensive coverage for a wide range of healthcare services. |

Enhancing Medicare Coverage with AARP Secondary Insurance

- Scenario 1: A Medicare beneficiary requires frequent dental work, which is not covered by Original Medicare. By enrolling in an AARP secondary insurance plan that includes dental coverage, the beneficiary can receive the necessary dental care without incurring high out-of-pocket costs.

- Scenario 2: A beneficiary relies on expensive prescription medications but is in the Medicare Part D “donut hole.” With AARP secondary insurance providing prescription drug coverage, the beneficiary can continue to access their medications at a more affordable cost.

Cost and Premium Information

When considering AARP secondary insurance in addition to Medicare coverage, it is essential to understand the associated costs and premium details. Let’s break down the key points related to the expenses involved.

Cost Breakdown

- AARP secondary insurance plans typically come with monthly premiums that vary based on the specific plan chosen. These premiums are in addition to the standard Medicare premiums that you already pay.

- The cost of AARP secondary insurance can also depend on factors such as your age, location, and the level of coverage you select.

- It’s important to note that out-of-pocket expenses like deductibles, copayments, and coinsurance may apply with AARP secondary insurance plans, so be sure to review the details carefully.

Premium Rates Determination

- The premium rates for AARP secondary insurance plans are typically determined based on various factors, including the level of coverage, your age, location, and the insurance company’s pricing structure.

- Insurance companies may also consider your health status and medical history when setting premium rates for AARP secondary insurance.

- It’s advisable to compare different plans and premium rates to find the most cost-effective option that meets your healthcare needs.

Managing Costs and Finding Affordable Options

- One way to manage costs with AARP secondary insurance is to carefully review your healthcare needs and select a plan that offers the right balance of coverage and cost.

- Consider exploring different insurance companies and plans to compare premium rates and coverage options to find the most affordable choice for your situation.

- Additionally, you can look into available discounts, subsidies, or cost-saving programs that may help reduce the financial burden of AARP secondary insurance.

Last Recap

In conclusion, AARP Secondary Insurance to Medicare stands as a crucial supplement to traditional Medicare coverage, offering a wide array of benefits and enhanced coverage options. By understanding the eligibility requirements, coverage details, and associated costs, individuals can make informed decisions to ensure their healthcare needs are met comprehensively.

FAQ

Is AARP Secondary Insurance mandatory for Medicare beneficiaries?

No, AARP Secondary Insurance is optional and serves as a supplement to enhance existing Medicare coverage.

Can individuals enroll in AARP Secondary Insurance at any age?

While there are no age restrictions, individuals must meet certain requirements to qualify for AARP Secondary Insurance.

How do premium rates for AARP Secondary Insurance plans get determined?

Premium rates for AARP Secondary Insurance plans depend on various factors such as age, location, and the level of coverage chosen.

What are some examples of services covered by AARP Secondary Insurance that Medicare may not fully cover?

AARP Secondary Insurance may cover services like dental, vision, and hearing care, which are not fully covered by traditional Medicare plans.