Exploring the realm of John Hancock Travel Insurance Cancel for Any Reason, this article delves into the specifics of its coverage, eligibility criteria, and more. Whether you’re a seasoned traveler or planning your first trip, understanding the ins and outs of this insurance can provide peace of mind and security.

From eligibility requirements to the claims process, this comprehensive guide aims to equip you with the necessary knowledge to make informed decisions when it comes to travel insurance.

Overview of John Hancock Travel Insurance Cancel for Any Reason

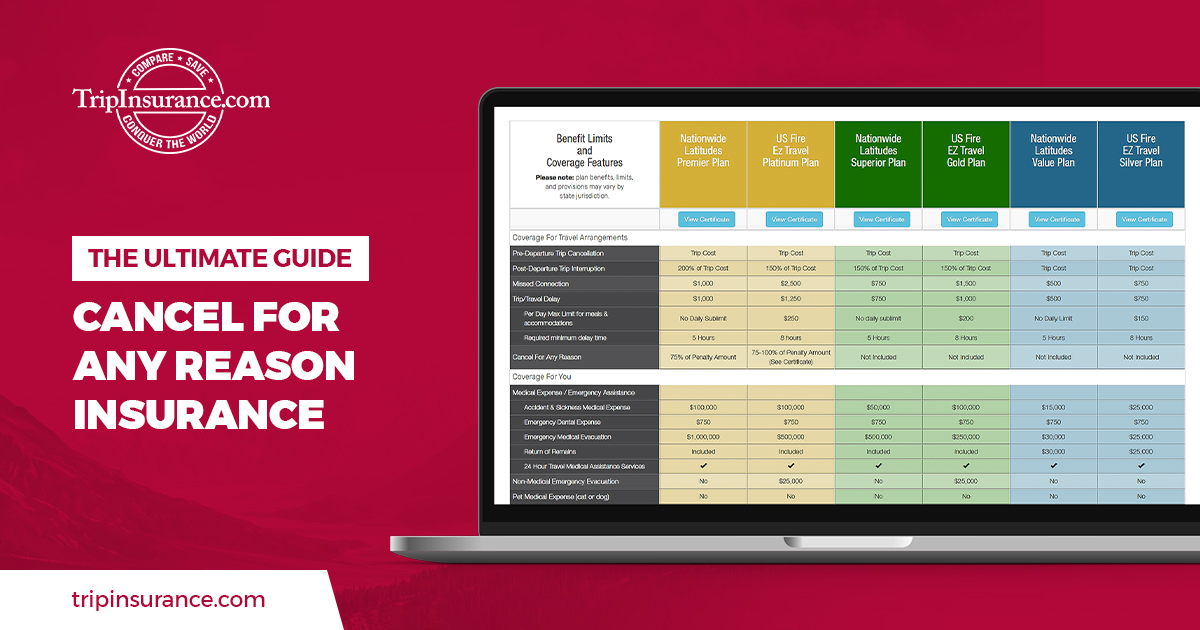

John Hancock Travel Insurance Cancel for Any Reason provides travelers with the flexibility to cancel their trip for any reason and receive a reimbursement of up to 75% of their non-refundable trip costs.

Coverage Details

- Flexible cancellation coverage up to 75% of trip costs.

- Refund for non-refundable trip expenses.

- Additional coverage for trip interruption and travel delays.

- 24/7 assistance services for emergencies during the trip.

Benefits of Having This Type of Travel Insurance

- Peace of mind knowing you can cancel your trip for any reason.

- Protection against financial loss due to non-refundable trip expenses.

- Assistance services available round the clock for any emergencies.

Eligibility and Requirements

To be eligible for John Hancock Travel Insurance Cancel for Any Reason, travelers must meet specific criteria and fulfill certain requirements. This type of insurance offers added flexibility and coverage, but there are limitations to consider.

Eligibility Criteria, John hancock travel insurance cancel for any reason

- Travelers must purchase the insurance within a specified time frame before their trip.

- Travelers must be medically fit to travel at the time of purchasing the insurance.

- Travelers must provide all necessary documentation and information required by the insurance provider.

Requirements

- Travelers must pay the premium for the Cancel for Any Reason coverage in addition to the standard travel insurance premium.

- Travelers must adhere to the terms and conditions Artikeld in the insurance policy to qualify for coverage.

- Travelers must notify the insurance provider of any trip cancellations or changes as soon as possible.

Limitations

- Coverage may have restrictions on the amount of reimbursement available for cancellations.

- Certain reasons for cancellation may not be covered under the Cancel for Any Reason policy.

- There may be specific deadlines or time frames for notifying the insurance provider of cancellations or changes.

Coverage Details

When it comes to John Hancock Travel Insurance Cancel for Any Reason, it is important to understand the specific situations that are covered, as well as any exclusions or limitations that may apply.

Covered Situations

- Illness or injury preventing you from traveling

- Death of a family member or travel companion

- Natural disasters affecting your travel destination

- Job loss or unexpected work obligations

- Terrorist incidents at your travel destination

Beneficial Scenarios

- Imagine you have to cancel your trip because you suddenly fall ill and are unable to travel.

- If a family member passes away and you need to cancel your travel plans to attend the funeral.

- In the unfortunate event of a natural disaster striking your destination, causing you to cancel your trip for safety reasons.

Exclusions and Limitations

- Pre-existing medical conditions may not be covered under this policy.

- Cancel for Any Reason coverage typically requires you to cancel your trip a certain number of days before departure.

- Some policies may have restrictions on the amount of reimbursement you can receive.

Claims Process

When it comes to filing a claim for John Hancock Travel Insurance Cancel for Any Reason, it is essential to follow the correct steps to ensure a smooth process. Here is an overview of what you need to know about the claims process, including the documentation required and the typical timeline for receiving reimbursement.

Filing a Claim

- Contact John Hancock Travel Insurance as soon as possible after canceling your trip for any reason to initiate the claims process.

- Provide all necessary documentation to support your claim, including proof of cancellation, receipts, and any other relevant information.

- Complete the claim form accurately and submit it along with the required documents for review.

Documentation Required

- Proof of trip cancellation due to any reason specified in your policy.

- Copies of receipts for any non-refundable expenses incurred, such as flights, accommodations, and tours.

- Medical documentation if the cancellation was due to an illness or injury.

Timeline for Processing Claims

- Once you have submitted your claim and all required documentation, John Hancock Travel Insurance will review the information provided.

- The typical timeline for processing claims can vary but expect to receive a decision within a few weeks to a month.

- If your claim is approved, reimbursement will be issued according to the terms of your policy.

Cost and Pricing

When it comes to John Hancock Travel Insurance Cancel for Any Reason, the cost of the insurance is determined based on several factors such as the age of the traveler, trip duration, destination, coverage limits, and any additional options selected. The premium for this type of insurance is typically higher compared to standard travel insurance due to the added flexibility of being able to cancel for any reason.

Comparison with Other Options

- John Hancock Travel Insurance Cancel for Any Reason may have a higher premium compared to traditional travel insurance policies that do not offer cancel for any reason coverage.

- However, when compared to other similar cancel for any reason policies in the market, John Hancock’s pricing may be more competitive with comprehensive coverage options.

Factors Influencing Price

- The age of the traveler: Older travelers may have higher premiums due to increased risk.

- Trip duration: Longer trips may result in higher premiums.

- Destination: Traveling to high-risk areas or countries with expensive healthcare may impact the price.

- Coverage limits: Higher coverage limits will result in higher premiums.

- Additional options: Any additional coverage options selected, such as adventure sports coverage or rental car coverage, will increase the price.

Customer Reviews and Satisfaction: John Hancock Travel Insurance Cancel For Any Reason

When it comes to John Hancock Travel Insurance Cancel for Any Reason, customer reviews and satisfaction play a crucial role in understanding the quality of the insurance coverage. Let’s take a look at some feedback from customers who have utilized this insurance option.

Positive Experiences and Testimonials

- Many customers have praised John Hancock Travel Insurance Cancel for Any Reason for its flexibility and comprehensive coverage.

- Some travelers have shared testimonials about how the insurance helped them recoup their expenses when they had to cancel their trip unexpectedly.

- Customers appreciate the peace of mind that comes with knowing they can cancel their trip for any reason and still be covered.

Common Complaints and Issues

- While most customers have positive experiences, some have raised concerns about the claims process being a bit lengthy or cumbersome.

- There have been a few complaints about certain exclusions in the coverage that were not clearly communicated upfront.

- A small number of customers have expressed dissatisfaction with the pricing of the Cancel for Any Reason option, feeling that it was too expensive compared to other travel insurance plans.

Last Point

In conclusion, John Hancock Travel Insurance Cancel for Any Reason offers a flexible and comprehensive solution for travelers looking to safeguard their trips. By understanding the coverage details, costs, and customer satisfaction levels, you can make an informed choice when considering this insurance option.

FAQ Compilation

What does “Cancel for Any Reason” mean?

Cancel for Any Reason coverage allows you to cancel your trip for any reason not covered by standard travel insurance policies, providing more flexibility.

Are there specific eligibility criteria for this type of insurance?

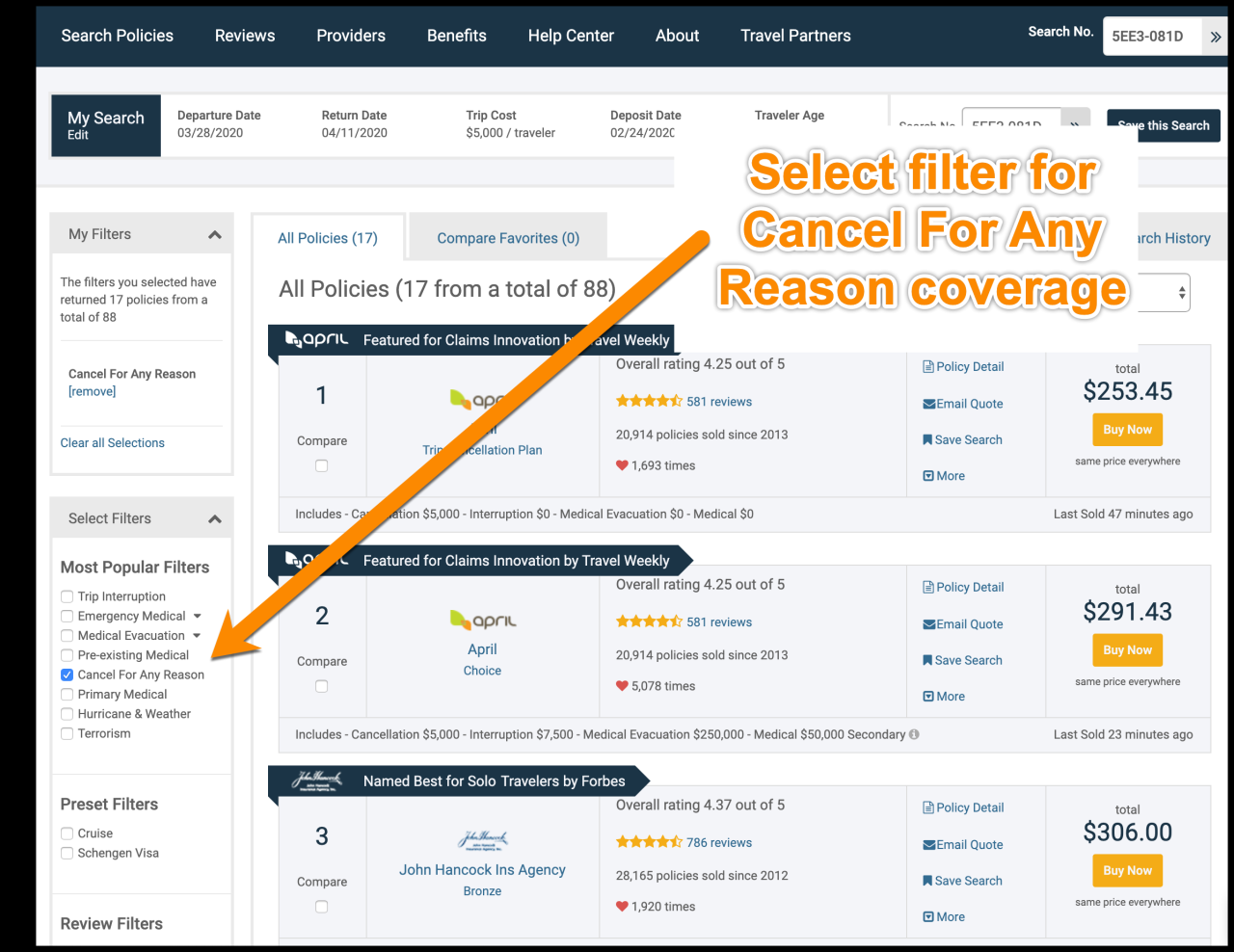

Yes, eligibility criteria typically include purchasing the insurance within a specified time frame from the initial trip deposit and meeting certain requirements set by the provider.

How is the cost of John Hancock Travel Insurance Cancel for Any Reason determined?

The cost is usually calculated based on factors such as the traveler’s age, trip cost, duration, and the level of coverage selected.