Is vision therapy covered by insurance? This opening paragraph aims to engage readers with a brief overview of the topic, exploring the importance of vision therapy and how insurance coverage works for it.

Vision therapy is a valuable treatment for certain conditions, and understanding insurance coverage for it is essential.

Overview of Vision Therapy Coverage by Insurance

Vision therapy is a specialized program designed to improve visual skills, eye tracking, and coordination. It is often used to treat conditions such as lazy eye, convergence insufficiency, and other vision-related issues that cannot be corrected with glasses or contact lenses.

Importance of Vision Therapy

- Vision therapy can improve eye coordination and focus, leading to better academic performance in children.

- It can help reduce eye strain and headaches caused by prolonged computer use or reading.

- For individuals with lazy eye or double vision, vision therapy can help improve depth perception and overall visual function.

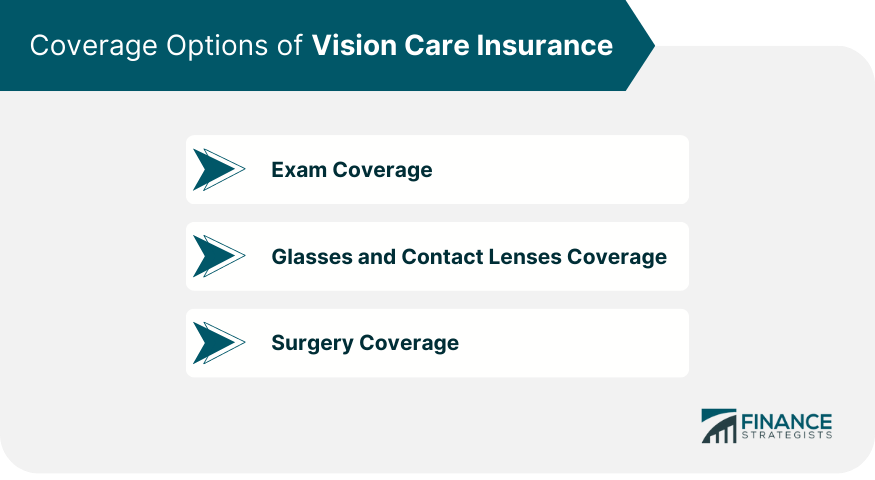

Insurance Coverage for Vision Therapy

Insurance coverage for vision therapy varies depending on the provider and the specific plan. Some insurance companies may cover a portion of the cost of vision therapy, especially if it is deemed medically necessary to treat a diagnosed vision condition. It is important to check with your insurance provider to understand what is covered and what out-of-pocket expenses you may incur.

Types of Insurance Plans That May Cover Vision Therapy

When it comes to covering vision therapy, various types of insurance plans may offer different levels of coverage. It is essential to understand which insurance providers typically cover vision therapy and the specific criteria required for coverage.

Private Health Insurance, Is vision therapy covered by insurance

- Private health insurance plans often offer coverage for vision therapy, but the extent of coverage can vary.

- Some private health insurance plans may require a referral from a primary care physician or an eye care specialist to approve coverage for vision therapy.

- It is important to check with your insurance provider about specific details regarding coverage limits, co-pays, and any pre-authorization requirements.

Medicare

- Medicare may cover some aspects of vision therapy if it is deemed medically necessary and prescribed by a qualified healthcare provider.

- Coverage under Medicare may be limited, and certain criteria must be met to qualify for reimbursement.

- It is advisable to consult with Medicare or your healthcare provider to understand the coverage options available for vision therapy.

Medicaid

- Medicaid coverage for vision therapy may vary by state, and specific guidelines may apply.

- Some Medicaid plans may cover vision therapy for children under certain circumstances, such as the presence of a diagnosed vision-related condition.

- Eligibility requirements and coverage details for vision therapy under Medicaid can differ, so it is recommended to verify coverage specifics with your state Medicaid office.

Factors Affecting Insurance Coverage for Vision Therapy

When it comes to insurance coverage for vision therapy, several factors can influence whether or not a particular treatment will be covered. Understanding these factors is crucial for individuals seeking vision therapy services.

Pre-Authorization Requirements for Vision Therapy

Insurance companies often require pre-authorization for vision therapy services. This means that the healthcare provider must obtain approval from the insurance company before starting treatment. Failure to obtain pre-authorization could result in the denial of coverage, leaving the patient responsible for all costs.

Diagnosis of Visual Conditions Impact on Coverage

The specific diagnosis of visual conditions can greatly impact insurance coverage for vision therapy. Some insurance plans may only cover therapy for certain diagnoses, while others may have broader coverage. It is essential for patients to have a clear understanding of their diagnosis and how it relates to their insurance coverage before beginning treatment.

Steps to Determine Vision Therapy Coverage

Determining whether your insurance plan covers vision therapy can be a complex process. Here are the steps you can take to verify your coverage and understand your policy better.

Verifying Insurance Coverage for Vision Therapy

- Contact your insurance provider: Reach out to your insurance company to inquire about coverage for vision therapy. Make sure to have your policy details handy.

- Ask specific questions: Inquire about the specifics of your coverage, such as copayments, deductibles, and any limitations on the number of sessions covered.

- Request pre-authorization: Some insurance plans require pre-authorization for vision therapy services. Be sure to follow the necessary steps to avoid claim denials.

Understanding Insurance Policies Related to Vision Therapy

- Review your policy documents: Take the time to carefully read through your insurance policy documents to understand the extent of coverage for vision therapy.

- Look for exclusions: Pay attention to any exclusions or limitations related to vision therapy in your policy. Understanding these can help you plan for out-of-pocket expenses.

- Consult with your provider: If you have trouble deciphering your insurance policy, consider consulting with your healthcare provider or an insurance specialist for clarification.

Submitting a Claim for Vision Therapy Services

- Keep detailed records: Maintain thorough documentation of your vision therapy sessions, including receipts, invoices, and any relevant medical reports.

- Submit claims promptly: Be sure to submit your claims for vision therapy services in a timely manner to expedite the reimbursement process.

- Follow up on claims: Stay proactive by following up on the status of your claims with your insurance company to ensure timely processing and payment.

Summary

In conclusion, navigating insurance coverage for vision therapy involves understanding different insurance plans, pre-authorization requirements, and the steps to determine coverage.

Detailed FAQs: Is Vision Therapy Covered By Insurance

Is vision therapy typically covered by insurance?

Yes, some insurance plans may cover vision therapy, but coverage can vary. It’s important to check with your specific provider.

What are common insurance plans that may cover vision therapy?

Common plans like PPOs and some HMOs may offer coverage for vision therapy, but it depends on the individual plan.

Are there specific criteria for coverage under different insurance plans?

Yes, each insurance plan may have its own criteria for covering vision therapy, such as the diagnosis and recommended treatment plan.

How can I verify if my insurance covers vision therapy?

You can contact your insurance provider directly to inquire about coverage for vision therapy and any necessary pre-authorization steps.