Humana Medicare Supplement Insurance Plans sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The coverage options, benefits, and eligibility criteria provide a robust foundation for understanding the world of Humana plans.

Overview of Humana Medicare Supplement Insurance Plans

Humana offers a range of Medicare Supplement Insurance Plans to help cover costs that Original Medicare may not cover. These plans are designed to provide peace of mind and financial protection for Medicare beneficiaries.

Coverage Options Available

- Medicare Part A coinsurance and hospital costs

- Medicare Part B coinsurance or copayment

- Blood coverage

- Hospice care coinsurance or copayment

- Skilled nursing facility care coinsurance

Benefits of Choosing a Humana Plan

- Freedom to choose any doctor or hospital that accepts Medicare patients

- Predictable out-of-pocket costs

- No referrals needed to see a specialist

- Additional benefits like fitness and wellness programs

- Access to customer service support for any questions or concerns

Eligibility Criteria for Enrolling in Humana Medicare Supplement Insurance Plans

To be eligible for a Humana Medicare Supplement Insurance Plan, you must be enrolled in Medicare Part A and Part B. It is also important to note that you cannot have both a Medicare Advantage Plan and a Medicare Supplement Insurance Plan at the same time.

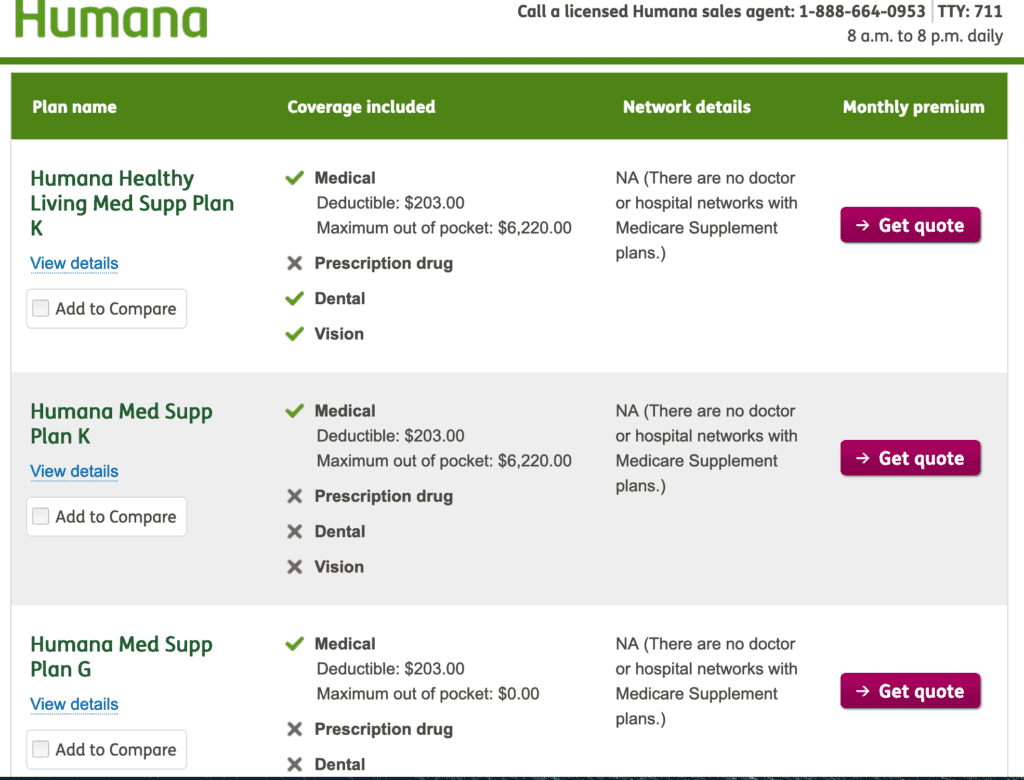

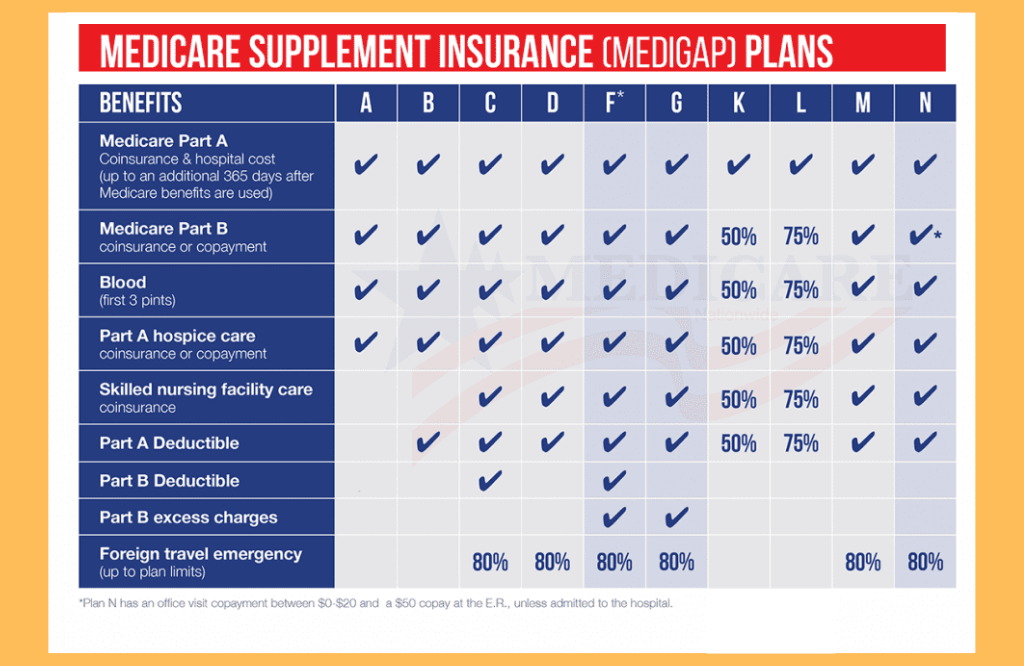

Types of Humana Medicare Supplement Insurance Plans

Humana offers a variety of Medicare Supplement Insurance Plans to help cover costs not covered by Original Medicare.

Plan A

- Provides basic benefits such as Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up.

- Costs may vary depending on age, location, and other factors.

- Suitable for those looking for minimal coverage at a lower premium.

Plan B

- Includes all the benefits of Plan A and adds coverage for Medicare Part A deductible.

- May have higher premiums compared to Plan A.

- Recommended for individuals who want more coverage for hospital costs.

Plan F, Humana medicare supplement insurance plans

- Covers all the benefits of Plan B and also includes coverage for Medicare Part B deductible.

- One of the most comprehensive plans offered by Humana.

- Popular choice for those seeking extensive coverage with minimal out-of-pocket expenses.

Plan G

- Similar to Plan F, but does not cover the Medicare Part B deductible.

- Can be a cost-effective alternative to Plan F for those willing to pay the deductible themselves.

- Good option for individuals looking for comprehensive coverage with lower premiums.

Plan N

- Covers most Medicare expenses but requires copayments for certain services.

- Offers lower premiums compared to Plans F and G.

- Suitable for individuals willing to pay some out-of-pocket costs in exchange for lower monthly premiums.

Coverage Details and Benefits: Humana Medicare Supplement Insurance Plans

Medicare Supplement Insurance Plans offered by Humana provide coverage for various expenses that are not covered by Original Medicare. These plans help fill the gaps in healthcare coverage and offer additional benefits to beneficiaries.

Covered Expenses

- Medicare Part A coinsurance and hospital costs

- Medicare Part B coinsurance or copayment

- Blood transfusions

- Hospice care coinsurance or copayment

- Skilled nursing facility care coinsurance

Additional Benefits

- Coverage for emergency medical care during foreign travel

- Access to SilverSneakers fitness program

- Discounts on vision and dental care

- Telehealth services for virtual doctor visits

Filling the Gaps in Original Medicare

Humana Medicare Supplement Insurance Plans help fill the gaps in Original Medicare coverage by paying for certain out-of-pocket costs, such as deductibles, copayments, and coinsurance. This ensures that beneficiaries have comprehensive coverage for their healthcare needs and reduces their financial burden when accessing medical services.

Enrollment Process and Requirements

To enroll in a Humana Medicare Supplement Insurance Plan, follow these steps and meet the necessary requirements to ensure a smooth enrollment process.

Enrollment Steps

- Contact Humana: Reach out to Humana via phone or online to express your interest in enrolling in a Medicare Supplement Insurance Plan.

- Choose a Plan: Select the specific Humana Medicare Supplement Insurance Plan that best fits your healthcare needs and budget.

- Complete Application: Fill out the enrollment application accurately and make sure to provide all required information.

- Submit Application: Send in your completed application to Humana through the method specified in the enrollment instructions.

- Review and Confirm: Review the details of your application and confirm that all information is correct before final submission.

- Receive Confirmation: Once your application is processed and approved, you will receive confirmation of your enrollment in the chosen plan.

Enrollment Requirements

- Medicare Part A and Part B: To be eligible for a Humana Medicare Supplement Insurance Plan, you must be enrolled in Medicare Part A and Part B.

- Age Requirement: There may be age requirements to enroll in certain plans, so ensure you meet the age criteria for the plan you choose.

- Enrollment Period: It is important to enroll during the Initial Enrollment Period or a Special Enrollment Period to avoid any penalties or restrictions.

- Health Status: While most plans do not require medical underwriting during specific enrollment periods, your health status may affect eligibility for certain plans.

Network Coverage and Provider Options

When it comes to Humana Medicare Supplement Insurance Plans, understanding the network coverage and provider options is crucial for making informed healthcare decisions. Let’s delve into how the network works and the flexibility you have in choosing healthcare providers.

Network of Healthcare Providers

Humana has a vast network of healthcare providers and facilities, including doctors, hospitals, specialists, and pharmacies. This network is designed to offer you access to quality care and services in your area.

- Providers within the network have agreed to accept the insurance plan’s negotiated rates, which can result in lower out-of-pocket costs for you.

- Out-of-network providers are those who have not agreed to the plan’s rates, which may lead to higher costs for services.

In-Network and Out-of-Network Services

Understanding the difference between in-network and out-of-network services is essential for maximizing your benefits and minimizing expenses.

- In-Network Services: When you choose healthcare providers within the Humana network, you typically pay lower costs for covered services.

- Out-of-Network Services: If you decide to see a provider outside the network, you may have higher out-of-pocket expenses or limited coverage, depending on the plan.

Flexibility in Choosing Healthcare Providers

With Humana Medicare Supplement Insurance Plans, you have the flexibility to choose your healthcare providers, whether they are in-network or out-of-network. This gives you the freedom to see specialists or receive care from providers you trust, even if they are not in the network.

By understanding the network coverage and provider options offered by Humana plans, you can make informed decisions about your healthcare and ensure you receive the care you need.

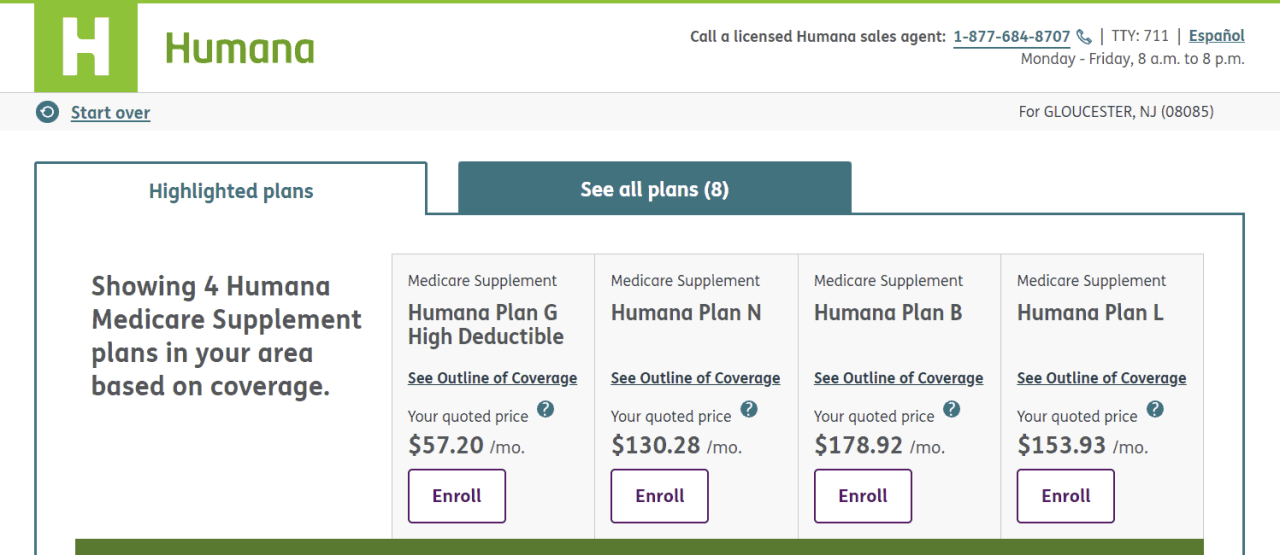

Cost and Pricing Information

When considering Humana Medicare Supplement Insurance Plans, it is essential to understand the costs associated with these plans. The costs can vary based on the specific plan chosen and the coverage it provides.

Premiums, Deductibles, and Copayments

Humana Medicare Supplement Insurance Plans typically involve the following costs:

- Premiums: This is the amount you pay each month for your insurance coverage. Premiums can vary depending on the plan you choose and your location.

- Deductibles: This is the amount you need to pay out of pocket before your insurance coverage kicks in. Different plans may have different deductible amounts.

- Copayments: These are fixed amounts you pay for covered services after you have paid your deductible. The specific copayment amounts can vary based on the plan.

Cost Variations Based on Plan

The costs of Humana Medicare Supplement Insurance Plans can vary based on factors such as the level of coverage, the specific benefits included, and your location. For example, a plan with more comprehensive coverage may have higher premiums but lower out-of-pocket costs, while a plan with basic coverage may have lower premiums but higher copayments.

Final Conclusion

In conclusion, Humana Medicare Supplement Insurance Plans stand out for their comprehensive coverage, network options, and cost-effective solutions. With a focus on bridging the gaps in Original Medicare coverage, these plans offer peace of mind and quality care for enrollees.

Query Resolution

What are the most common coverage options available with Humana Medicare Supplement Insurance Plans?

Humana offers various coverage options such as hospital stays, doctor visits, and prescription drugs to help fill the gaps in Original Medicare.

Is there a difference in cost between the different types of Humana Medicare Supplement Insurance Plans?

Yes, the costs can vary based on the plan chosen. Factors such as premiums, deductibles, and copayments contribute to the overall cost.

How do I enroll in a Humana Medicare Supplement Insurance Plan?

To enroll, you need to follow the steps Artikeld by Humana, meet any eligibility requirements, and be mindful of enrollment deadlines.

Are there any additional benefits or perks included in Humana Medicare Supplement Insurance Plans?

Yes, Humana plans may offer additional benefits like wellness programs, vision coverage, or fitness benefits depending on the specific plan.

Can I choose my healthcare provider with Humana Medicare Supplement Insurance Plans?

Yes, Humana plans offer flexibility in choosing healthcare providers, with options for in-network and out-of-network services depending on the plan.