Do you have to be a AAA member for insurance? This question sparks curiosity and is the gateway to understanding the relationship between AAA membership and insurance coverage. Exploring this topic will shed light on the benefits, requirements, and impact of being a AAA member on insurance.

Understanding AAA Membership

AAA membership is a service provided by the American Automobile Association that offers various benefits to its members. These benefits include roadside assistance, travel discounts, insurance coverage, and more. Being a AAA member can provide peace of mind and savings for individuals and families alike.

Benefits of Being a AAA Member, Do you have to be a aaa member for insurance

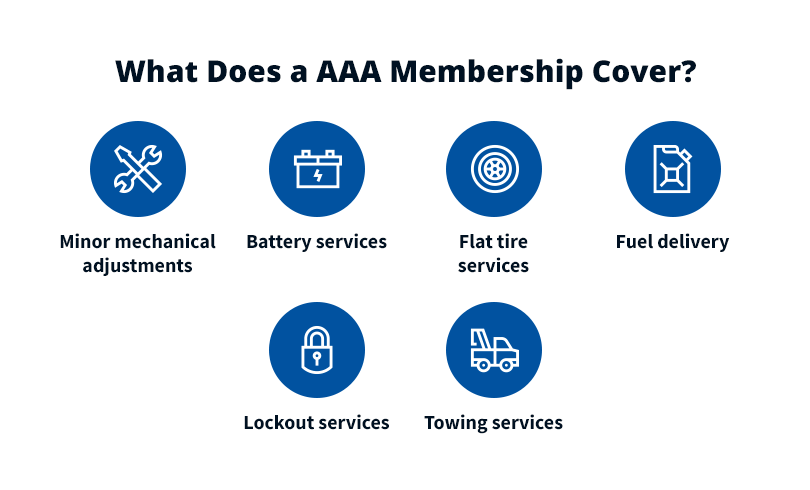

- 24/7 Roadside Assistance: AAA members can receive help with flat tires, dead batteries, towing, and more, anytime and anywhere.

- Travel Discounts: Members can enjoy discounts on hotels, rental cars, and attractions, making vacations more affordable.

- Insurance Coverage: AAA offers various insurance products, including auto, home, and life insurance, providing members with additional protection and savings.

- Member Rewards: AAA members can earn points for every dollar spent on eligible purchases, which can be redeemed for gift cards, travel vouchers, and more.

How AAA Membership Relates to Insurance Coverage

AAA membership can directly impact insurance coverage options for individuals. By being a AAA member, individuals may have access to discounted insurance rates and specialized coverage options tailored to their needs. Additionally, AAA’s insurance products are backed by the association’s reputation for excellent customer service and reliability, giving members added confidence in their coverage choices.

Insurance Options Available with AAA

AAA offers a variety of insurance options to meet the needs of its members. From auto insurance to homeowners insurance, AAA provides coverage for a range of situations to ensure peace of mind and financial protection.

Types of Insurance Offered by AAA

- Auto Insurance

- Homeowners Insurance

- Renters Insurance

- Life Insurance

- Travel Insurance

Coverage Options Provided by AAA Insurance

- Liability Coverage

- Comprehensive Coverage

- Collision Coverage

- Uninsured/Underinsured Motorist Coverage

- Personal Injury Protection

- Property Damage Liability

Structure of AAA Insurance Plans

AAA insurance plans are structured to provide comprehensive coverage at competitive rates. Members can customize their plans to suit their individual needs, whether it’s for their vehicles, homes, or personal well-being. AAA offers flexible payment options and discounts for members to make insurance more affordable and accessible.

Membership Requirements for Insurance: Do You Have To Be A Aaa Member For Insurance

AAA membership is typically a prerequisite for purchasing insurance through AAA. However, the specific requirements may vary depending on the type of insurance and the region you are in. It is best to check with your local AAA branch for detailed information on membership requirements for insurance coverage.

Discounts and Special Offers for AAA Members

- AAA members often enjoy exclusive discounts and special offers on insurance policies. These discounts can help members save money on their premiums and overall insurance costs.

- Some common discounts for AAA members include multi-policy discounts, safe driver discounts, and loyalty discounts for long-term members.

- Additionally, AAA members may have access to unique benefits and perks that are not available to non-members, making AAA insurance a valuable option for those who are already part of the AAA network.

Comparison of Insurance Rates for AAA Members vs. Non-Members

- AAA insurance rates for members are often competitive and can sometimes be lower than the rates offered to non-members. This is because AAA is able to leverage its network and resources to provide cost-effective insurance options to its members.

- Non-members may still be able to purchase insurance through AAA, but they might not be eligible for the same discounts and benefits that members receive. As a result, non-members may end up paying higher premiums for comparable coverage.

- Overall, becoming a AAA member can not only give you access to a wide range of insurance options but also help you save money on your insurance premiums through exclusive discounts and special offers.

AAA Membership Impact on Insurance Claims

Being a AAA member can have a significant impact on the insurance claiming process, providing various advantages and benefits that non-members may not have access to.

Advantages of AAA Membership in Insurance Claims

- Priority Service: AAA members often receive priority service when filing insurance claims, leading to quicker processing and resolution of issues.

- Special Discounts: Members may be eligible for special discounts on insurance premiums or deductibles, ultimately saving them money in the long run.

- 24/7 Roadside Assistance: In case of accidents or emergencies, AAA members can benefit from 24/7 roadside assistance, ensuring help is always just a phone call away.

Testimonials and Experiences

“Thanks to my AAA membership, I was able to get my insurance claim processed smoothly and efficiently, without any hassle. The discounts I received also helped me save a significant amount of money.” – AAA Member

“When I got into a car accident, the 24/7 roadside assistance provided by AAA was a lifesaver. It gave me peace of mind knowing that help was on the way, and the insurance claiming process was handled promptly.” – AAA Member

Last Point

In conclusion, the necessity of AAA membership for insurance, the various insurance options available with AAA, and the advantages for members in the claiming process highlight the significance of being a part of AAA. Whether you’re a current member or considering joining, knowing these details can help you make informed decisions about your insurance needs.

FAQs

Is AAA membership mandatory for getting insurance?

No, AAA membership is not mandatory for purchasing insurance, but it may offer discounts and special offers to members.

What are the advantages of being a AAA member for insurance claims?

AAA members may have smoother and faster insurance claim processes, along with potential discounts on premiums.

Are insurance rates different for AAA members compared to non-members?

AAA members might enjoy lower insurance rates or exclusive deals that are not available to non-members.